Navigating Gamma Exposure and Delta Hedging in Short-Duration Markets

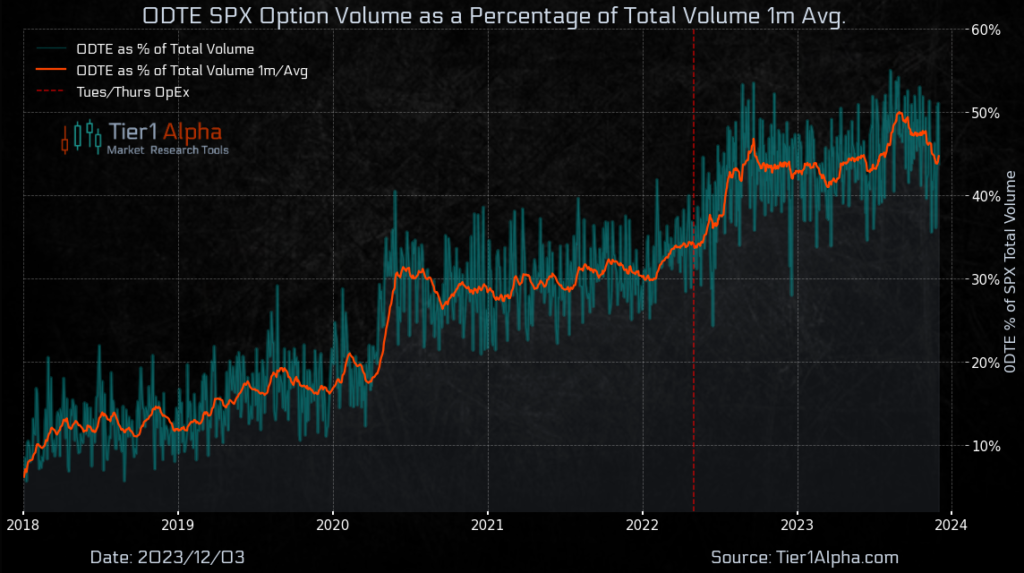

In the realm of 0DTE (zero days to expiration) flows, a notable yet often overlooked detail is that over 85% of these contracts are hedged using options that are further out-of-the-money instead of traditional delta hedging with the underlying asset. This preference among option dealers highlights the superiority of options as a hedging tool in short-duration markets, offering distinct advantages in areas such as risk management, cost efficiency, and overall market impact.

1. The Superiority of Option-Based Hedging

Market makers who deal in 0dte contracts often prefer hedging with short-dated options, and here’s why:

- Concave Instruments and Reduced Transactions: When a dealer hedges a 25-delta option with a future, they are obliged to adjust their position if the delta changes. However, if they hedge a 25-delta option with 2.5 times a 10-delta option, both instruments’ deltas align more closely. This similarity in delta progression means fewer adjustments and the ability to provide delta to the market as needed.

- Lower Transaction Costs: While dealers typically operate both futures and options desks, opting to hedge within their own book of options reduces internal transaction costs. This approach not only simplifies the profit and loss statement but also potentially enhances profitability.

- Risk Capital Optimization: Hedging with instruments that have mismatched expiries, like daily options and monthly futures, complicates risk metrics due to the basis differential. Furthermore, pairing an instrument with volatility exposure (options) against one without direct volatility implications (futures) introduces vega exposures that must be managed separately. By using options for hedging, dealers can more effectively manage their risk capital.

2. Market Impact and Considerations

While this is an effective way to hedge their exposure, dealers need these options to be highly liquid to transact with them efficiently. If dealers find themselves beyond the scope of these liquid strikes, it’s likely they’ll have to turn to the futures market to make up the difference. The market must bear the higher costs outlined above in the form of higher implied volume, wider bid/ask, and a deterioration in liquidity.

In conclusion, the strategic application of short-dated options for hedging in 0DTE flows brings substantial benefits for market makers, notably in reducing transaction costs, optimizing risk capital, and achieving more accurate delta alignment. However, it’s imperative to recognize that the efficacy of these strategies is largely dependent on the liquidity within the options market. Outside of there, these flows can start to have a more material impact on the underlying market, which, in this case, is the S&P 500. For traders and investors, understanding and tracking where these liquidity thresholds lie is critical for effectively navigating the complex and constantly shifting landscape of financial markets.